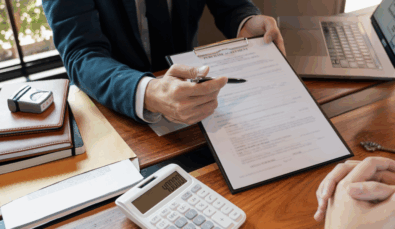

Tax Effective Self Managed Super Funds Strategies

For many of us, superannuation is one of our biggest long-term investments so it makes sense to invest in sound advice. Our SMSF accountants in Brisbane and on the Gold Coast can provide exactly what you need to establish and run a self-managed superannuation fund.

At MGI South Queensland, we take the stress out of important questions like, how much super is enough? We’ll guide you through tax-effective super strategies and make sure you are financially prepared for retirement.

Do you have the right superannuation strategy to achieve your retirement goals?

Let our specialist SMSF accountants in Brisbane guide you through developing an effective super strategy. Book an obligation-free consultation today to review how your superannuation is performing and strategies you can adopt for improvement. Conditions apply.

Our SMSF accountants can support you with:

How our SMSF accountants can help

Plan for retirement

We’ll help you to identify your goals for retirement and then build the right team of advisors to achieve this.

Determine your super strategy

We’ll help you establish a superannuation strategy and keep these goals front of mind throughout your working life.

Set up and manage a SMSF

SMSFs are an increasingly popular option for many Australians. We’ll help you assess the advantages and then manage the minefield of rules and regulations.

Build your super through reducing the tax you pay

A number of tax-effective strategies will help you improve your super return. We make sure you’re taking advantage of these opportunities.

Review ongoing performance

The performance of your superannuation will depend on how you’ve invested your money. We can refer you to a trusted financial planner who can make recommendations.