Following on from our post a couple of months ago about tax and superannuation deadlines the following are the upcoming contribution cap and superannuation changes.

1. Contributions – cap increase

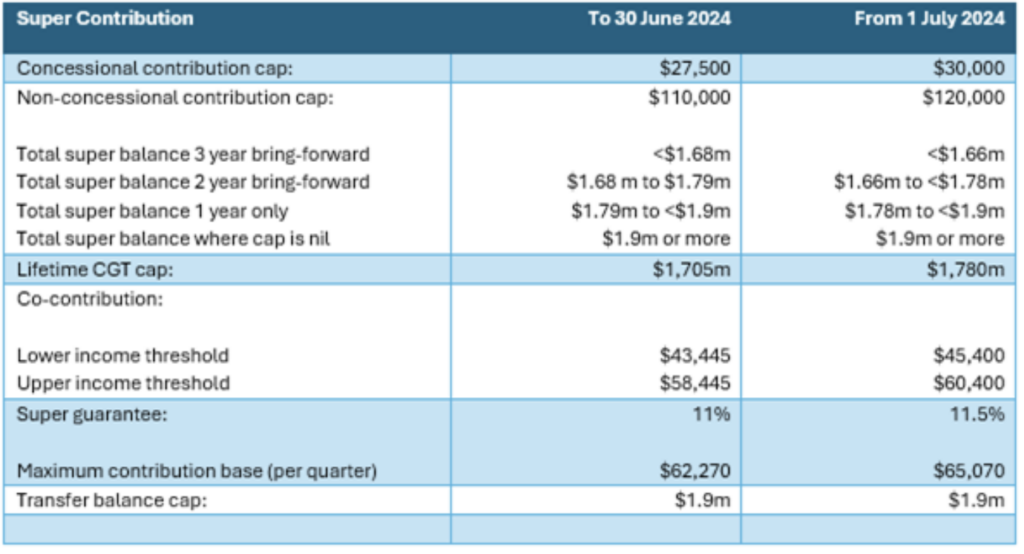

From 1 July 2024 a number of rates and thresholds will increase, including the contribution caps. There has been no further indexing of the transfer balance cap so there will be changes to the eligibility to use the 3 year bring forward non-concessional contributions (see table below).

A reminder to review any salary sacrifice agreements to avoid excess concessional contributions with the increase in super guarantee to 11.5% from 1 July 2024.

2. Defined benefit interest (CSS/PSS) calculation for Division 296 – in relation to superannuation balances above $3million

From 1 July 2025 tax concessions will be reduced for certain earnings for superannuation balances above $3 million. On 28 February 2023, the Australian Government announced from 1 July 2025 a 30% concessional tax rate will be applied to future earnings for superannuation balances above $3 million, known as Division 296.

If you are wondering how the balance of your CSS or PSS pension will be calculated for the purposes of the proposed Division 296 tax you will need to wait a little longer.

While draft legislation has been released, the calculations for determining the balance of defined pensions will be contained in the regulations which no one has seen (or possible written).

3. Reminder about the changes in Small Business Super Clearing House

From 15 March 2024, the ATO will introduce SMSF bank account validation in the Small Business Superannuation Clearing House (SBSCH). This will require any small employer using the SBSCH to ensure that their employees’ SMSF bank accounts match the bank account details registered with the ATO for contributions.

If you are receiving contributions via SBSCH or using the SBSCH to pay employer contributions, it is important to contact employees to confirm that the SMSF bank account that superannuation contributions are paid to, is the same as the SMSF bank account registered against the superannuation role, with the ATO. A mismatch will mean that their superannuation contributions can’t be processed through the SBSCH.

This also applies for any member roll-in and roll-out requests.

Please contact us if you need to check the details of the bank account registered with the ATO for your SMSF.

Proactive steps are essential to ensure any SG obligations for the March 2024 quarter can be met by 28 April 2024.

4. Non-Arm’s Length Income/Expense (NALI/NALE) Bill Passed Through Parliament

An important reminder to the trustees and the members of the fund, that NALI/NALE bill has now passed through both houses of Parliament and it is essential to review all general expenses incurred/not-incurred within the fund.

It is crucial to understand and review transactions within the superfund that there is no expenditure at non-arm’s length that will trigger the rules concerning non-arm’s length income.

This rule specifically dives into general expenses such as discounted accounting or adviser fees, legal fees or any other general expenses which are non-arm’s length.

If you have any queries or concerns or need further advice and support about superannuation changes please don’t hesitate to reach out to the team at MGI.